Speaking on this week’s Q3 earnings call, PayPal CEO Dan Shulman clearly had a sense of the moment we are in. He painted a picture of a global economy characterized by a decline in cash usage and a commensurate rise in fintech innovation. He also outlined how PayPal has capitalized on trends in payments infrastructure accelerated by the pandemic, from digital wallets to contactless payments technology to cryptocurrency.

“As the use of cash continues to decline, new and innovative financial technologies are rising. For example, central banks around the world are seriously exploring or even trialing forms of retail digital currencies that they issue directly, Shulman said on the earnings call. “And it’s also clear that digital wallets are a natural complement to all forms of digital currencies. These trends create an opportunity for us to work with central banks and regulators to shape a modern and inclusive financial system built on a more efficient digital infrastructure designed for the future.”

A Contactless Future

Shulman said that PayPal’s future growth prospects hinge on the digitization of the global economy. And on the growth of digital wallets. Digital wallets (or e-wallets) allow consumers to store logins for numerous payment methods or websites in a single application. In theory, at least, a digital wallet eliminates the need for consumers to carry cash or physical credit cards. Paypal made it clear on the call that it is placing its bets on this technology.

“We are investing to create one of the most compelling and expansive digital wallets in the world and you can see this beginning to play out in our strong Q3 results. In Q3, our total payment volume grew by a record 36% on an FX-neutral basis to $247 billion, an annual run rate just shy of $1 trillion. Even more impressive is the growth of our volumes, excluding eBay, which grew 38%, eclipsing any previous record,” Schulman said.

Transforming PayPal, Venmo Apps

PayPal announced it will invest in “fundamentally” transforming both its PayPal and Venmo apps over the next year. The vision is something that might be described as a financial super app.

“This expanded suite of services will include enhanced direct deposit and check cashing, budget and savings tools, bill pay, investment alternatives, including crypto, subscription management, buy now, pay later optionality, and all of Honey’s shopping tools from wish lists, price monitoring, deals, coupons, and rewards,” Shulman said. Honey is the digital coupon company that PayPal acquired last year for $4 billion.

PayPal also has big ambitions in physical retail. Shulman reported that PayPal has signed a number of deals to install its QR-code-based contactless payment solution in retailers nationwide. Shulman cited CVS, Nike, Tumi, Bed Bath & Beyond, and Samsonite on the call as retailers who have adopted the system. Notably, QR codes have experienced a rival during COVID. Many restaurants, for example, have abandoned paper menus in favor of online menus accessed via QR code.

Big Bet on Crypto

Cryptocurrency will play a central role in this expansive digital payments future Shulman describes. In October, PayPal announced a new service that allows consumers to acquire and trade cryptocurrencies directly from their PayPal accounts. Currently, this is only available in the U.S. PayPal intends to expand this internationally and to Venmo during 1H 2021.

Shulman said this will lead to wider acceptance of crypto as a form of payment.

“We will rapidly move at the beginning of next year and allow consumers to use cryptocurrencies as a funding instrument to shop across all 28 million of our merchants,” Shulman said. “This solution will not involve any additional integrations, volatility risk, or incremental transaction fees for, either consumers or merchants and will fundamentally bolster the utility of cryptocurrencies.”

Early Days for SMB Crypto

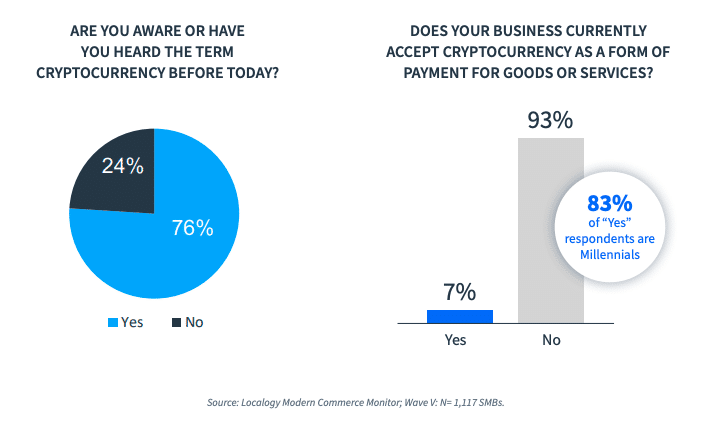

So how ready are SMBs to embrace crypto? Well, earlier this year, Localogy asked small businesses about cryptocurrency in Wave V-1 of its Modern Commerce Monitor™ tracking study. The bottom line? Most SMBs know what crypto ism but very few accept it as a form of payment. Even as operators like PayPayl and Square open up to crypto, getting SMBs comfortable with crypto will take time.

One interesting note. Among those SMBs that do accept crypto payments, 83% are in the millennial or younger age bracket. As with most things related to small business technology adoption, crypto’s acceptance will depend heavily on Baby Boomer (and older) SMBs retiring to make way for younger business owners.

More from Localogy